stock options tax calculator usa

Even taxpayers in the top income tax bracket pay long-term capital gains rates. Refer to Publication 525 for specific details on the type of stock option as well as rules for when income is reported and how income is reported for income tax purposes.

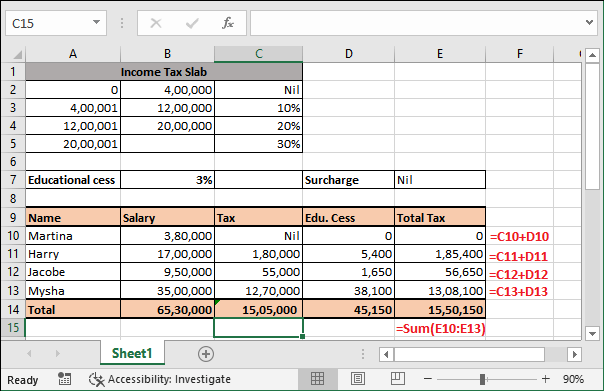

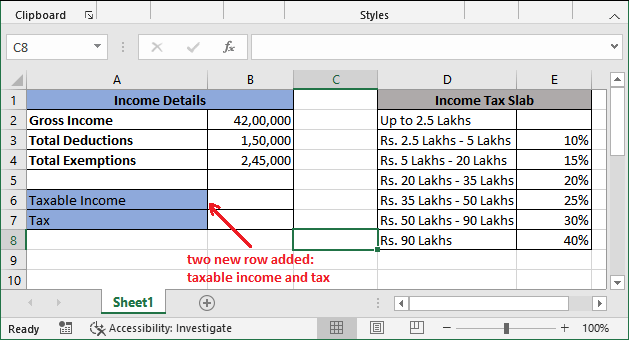

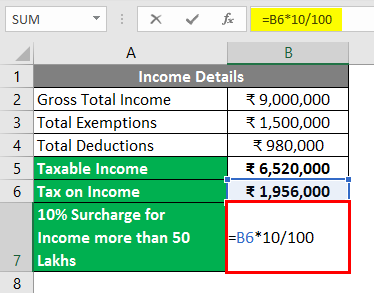

Income Tax Calculating Formula In Excel Javatpoint

Ad Free book shows how to generate 20196 per day trading options a couple times a week.

. On the date of exercise the fair market value of the stock was 25 per share which is. Enter what-if scenarios or. On this page is an Incentive Stock Options or ISO calculator.

Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. Ad Go From Rookie to Guru. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net.

Non Qualified Stock Options Calculator. Ad For Private and Public Companies Who Want Equity Plans Done Right. Maximize your stock compensation gains and prevent.

The inputs that can be adjusted are. Lets say you got a grant price of 20 per share but when you exercise your. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

The Option Calculator can be used to display the effects of changes in the inputs to the option pricing model. The results provided are an. You will only need to pay the greater of either your.

Ad For Private and Public Companies Who Want Equity Plans Done Right. 40 of the gain or loss is taxed at the short-term capital tax. Free Online Classes Open an Account Today.

When you hold your investment for over a year youll qualify for the. What will my options be worth if my companys stock price changes. Poor Mans Covered Call calculator addedPMCC Calculator.

Youll either pay short-term or long-term capital gains taxes depending on how long youve held the stock. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Locate current stock prices by entering the ticker symbol.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. See your gain taxes due and net proceeds with this calculator. Even after a few years of moderate growth stock options can produce a handsome return.

Exercising your non-qualified stock options triggers a tax. Options Trading For Newbies is written for beginners with small accounts. Section 1256 options are always taxed as follows.

You paid 10 per share the exercise price which is reported in box 3 of Form 3921. 60 of the gain or loss is taxed at the long-term capital tax rates. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. ISO startup stock options calculator. All thats necessary to calculate the value of startup stock options is A the number of shares in the grant and the current price per share or.

You can find your federal tax rate here. Find the best spreads and short options Our Option Finder tool. Receiving options for your companys stock can be an incredible benefit.

Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. Cash Secured Put calculator addedCSP Calculator. Taxes for Non-Qualified Stock Options.

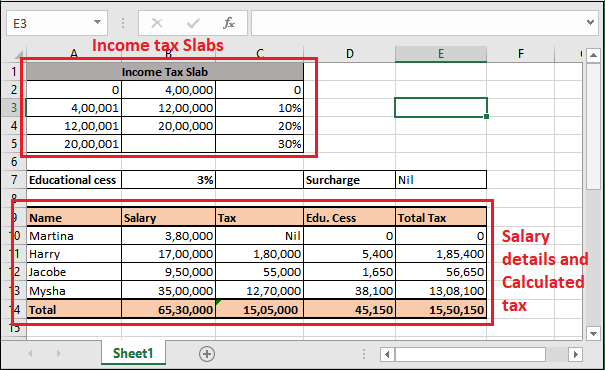

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

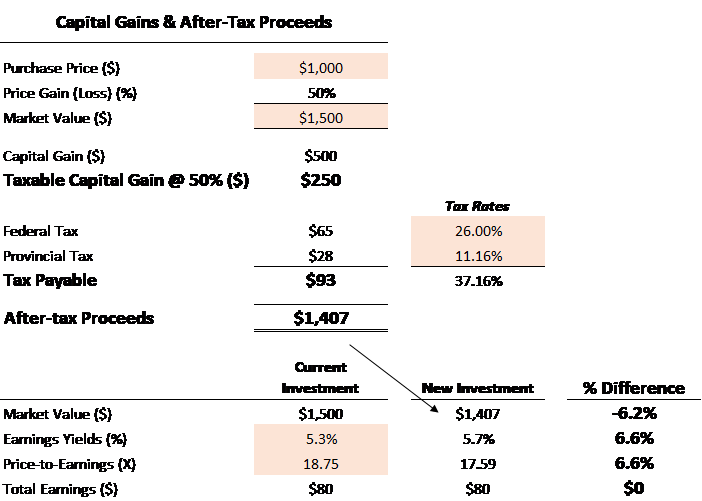

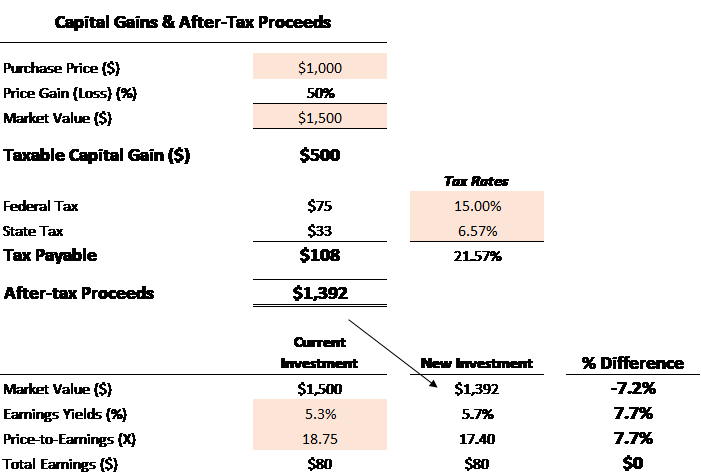

Capital Gains Tax Calculator For Relative Value Investing

Income Tax Calculating Formula In Excel Javatpoint

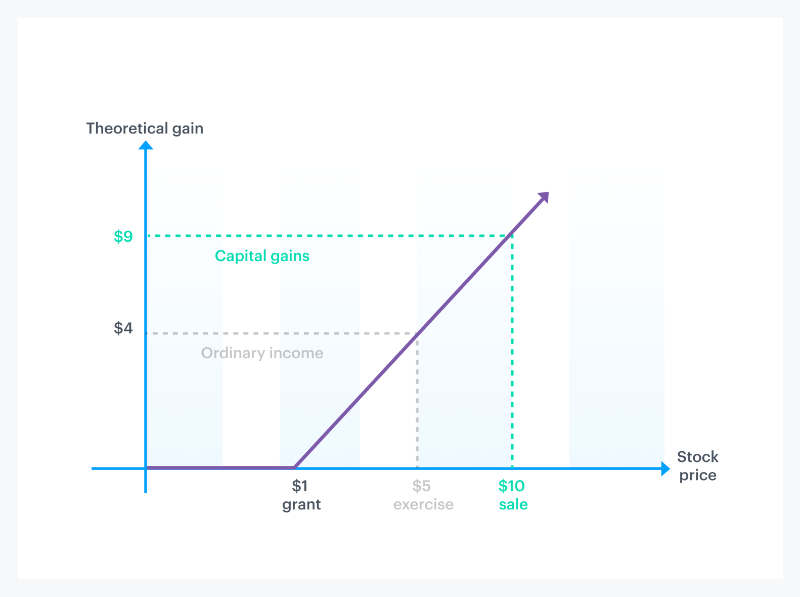

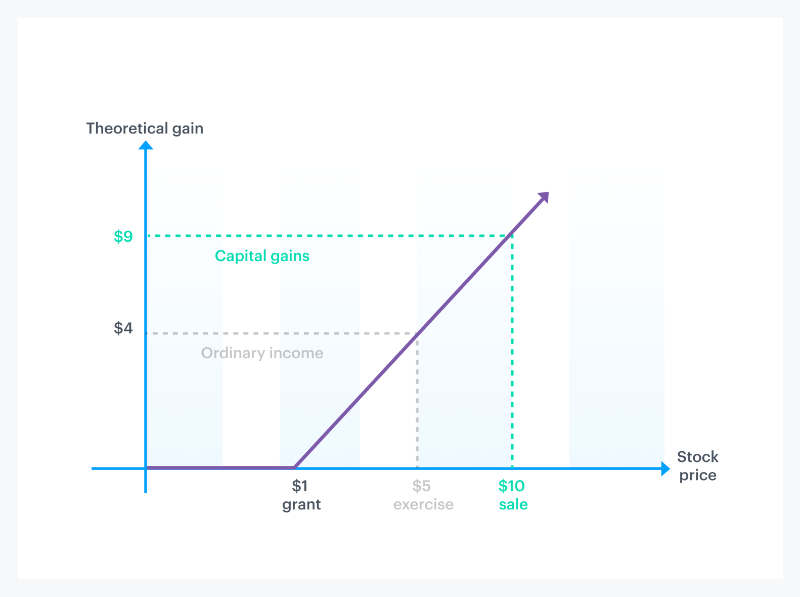

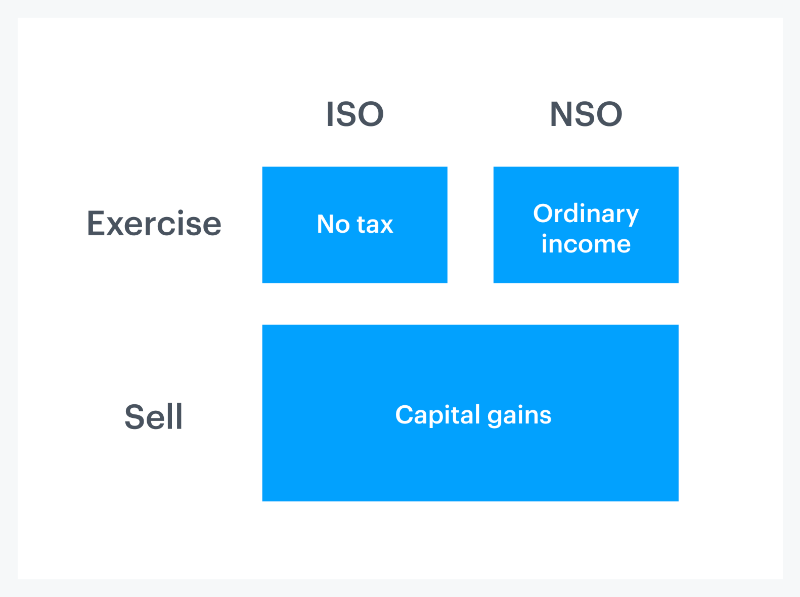

How Stock Options Are Taxed Carta

Tax Calculator Figure Your 2021 Irs Refund Before Filing Your Return

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Calculating Formula In Excel Javatpoint

![]()

1040 Income Tax Calculator Free Tax Return Estimator

Capital Gains Tax Calculator For Relative Value Investing

Capital Gains Tax Calculator 2022 Casaplorer

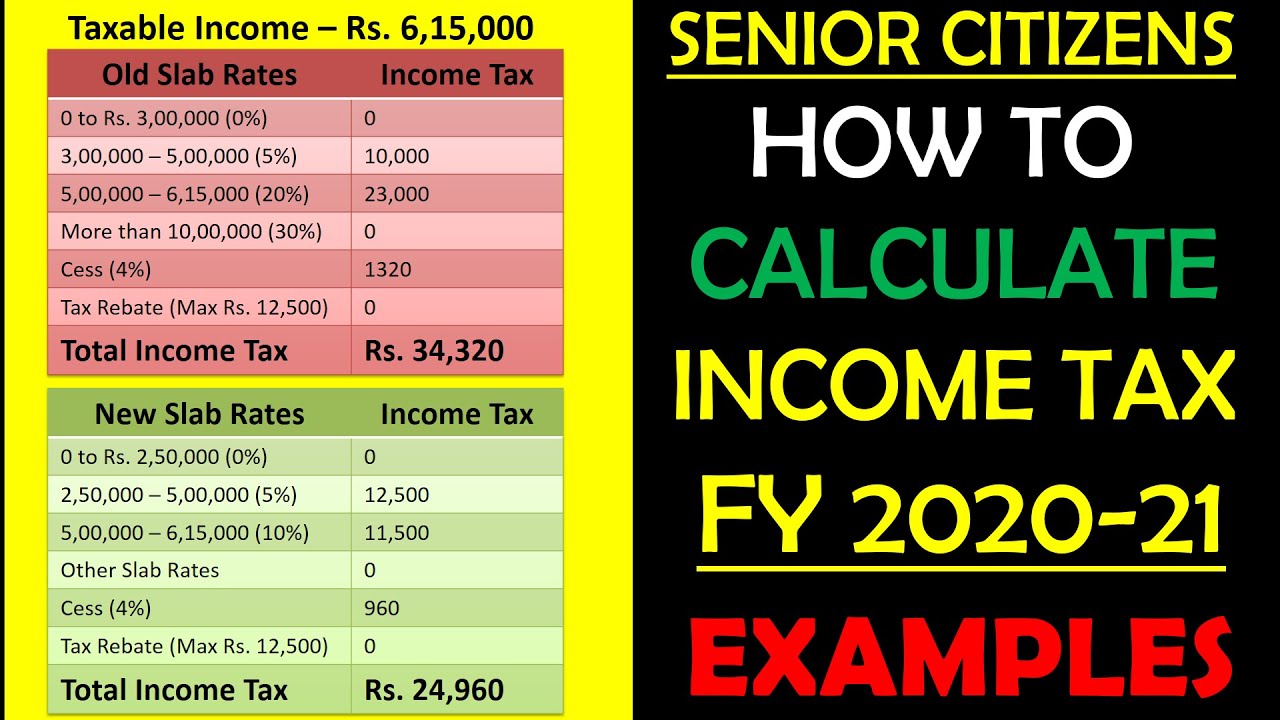

Income Tax Calculation Senior Citizens 2020 21 How To Calculate Income Tax Senior Citizens 2020 Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Dr Abdul Hafeez Shaikh Made A List Of Suggestions To Increase The Efficiency In Tax Collection And Improving In 2020 Online Taxes File Taxes Online Income Tax Return

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Tax Time Blue Tinted Image Of Calculator And Figures On Paper Selective Focus Ad Tinted Image Calculator Tax Time Ad Tax Time Tax Calculator

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Stock Options Are Taxed Carta

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe